Business bank card debt consolidation is currently becoming as common as individual credit card financial debt combination. With the fast lane as well as affordable nature these days’s culture it is very easy to see just how much we have involved depend on our adaptable good friends to see us via the difficult times. Certainly organization credit cards are a great method to sustain the needs of your service exactly when immediate profits is required. The ease of a service bank card enables you to make those all important purchases to keep your company on the top as well as relocating the ideal direction.

However, these aspects entirely will just make a success of your service if you use your service charge card with miraculous treatment.

If utilized unwisely, your business could suffer heavily under the concern of your business bank card financial debt as well as otherwise handled in the correct method, could even sink your organization entirely!

Identifying these signs early sufficient could be your financial lifesaver. With business credit card financial debt loan consolidation you are able to combine all your existing outstanding credit card fees right into one single low APR credit card. Numerous charge card companies offer a set period whereby the balance moved is 0% or a really reduced interest rate for a given time period. It is certainly worth making the effort to investigate the very best bargains on offer at that particular minute in time.

If however you really feel that the credit card transfer alternative is not quite what you are trying to find, then maybe the answer for you is an organization bank card debt loan consolidation loan.

These lendings come in 2 variations. Guaranteed and unprotected. A protected company credit card financial debt loan consolidation financing indicates that the finance itself will certainly be protected versus collateral offered on your own. With this course you will make sure a lower interest rate on your car loan. An unsafe company credit card debt loan consolidation lending typically implies a higher interest rate and also much stricter conditions to stick to.

The main benefits of this kind of financing are the flexible payment alternatives. you will have the ability to establish the moment scale that the car loan is paid back over. Undoubtedly, the longer the term, the lower the payments are mosting likely to be. This could well assist with that all important cash flow problem in the interim, yet on the other hand of the coin the loan will certainly be continuous for a longer duration. If you need to simplify accounting, read this article at this link.

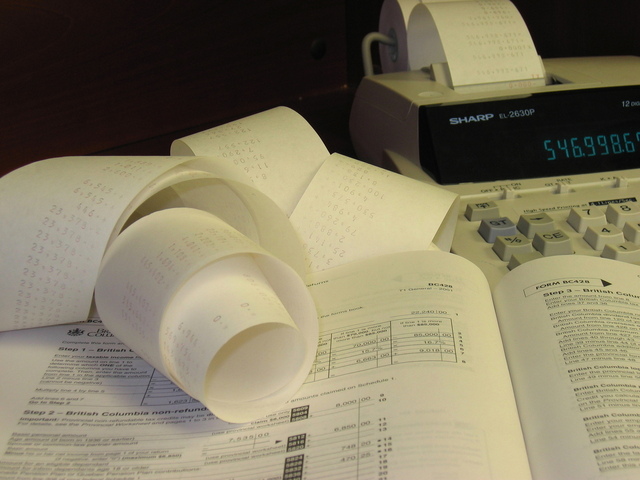

The main point is to firstly get a handle on your finances. At this phase, the essential thing is to examine what financial debt you remain in, what your incoming and outgoings are and to make a note of what you can manage to pay on a month-to-month basis. This may sound like an evident bit of suggestions, but it’s shocking the number of people obtain caught up in a whirlwind of financial ignorance.

Once you have done this analysis of your service funds you are in a good position to after that evaluate which type of financial assistance will best be suited to your company demands, Service Charge card Financial Obligation Loan Consolidation or a Company Bank Card Financial Debt Loan Consolidation Finance?